Do bad credit loans with no guarantor offer options?

CashFacts keeps various loan options accessible for people struggling with extremely poor credit scores. We have designed these categories according to your financial needs. In addition, we ensure you get something according to your pocket size when applying for bad credit loans with no guarantor.

Here, presenting the diverse opportunities that are waiting for you.

-

Debt consolidation loans

You might be going through a rough patch because of outstanding debts. Fret Not! We can help you to overcome this problem. All you need is debt consolidation loans available for bad credit in the UK. You are free from the compulsion of handling individual debts.

Now, you can consolidate all your debt payments to our loan and settle it finally. We will not raise any demand for collateral. You can directly receive loans in your bank account after approval.

-

Student loans

Do you want to support your educational expenses while studying and without a job? However, you are dependent on your parents to maintain your usual expenses. You have not started earning money yet.

Naturally, you do not have a credit history. This makes it hard for you to qualify for loans. Do not panic! You have an option of student loans available for bad credit. It accepts loan applicants with no credit history also.

-

Payday loans

We understand that the financial condition of a salaried person might deteriorate. For this reason, we provide payday loans for bad credit people also. According to us, repayment should be easygoing despite their bad credit setbacks.

You can take out an amount that suits your necessity and is repayable with the next pay check. So far as intermediate steps are concerned, our swift process will smooth your borrowing experience.

-

Guaranteed loans

Are you looking for loans that can give a guarantee of approval? In reality, such loans are non-existent. However, there could be situations when guaranteed loans for bad credit are accessible from a direct lender like us.

You can take advantage of features that a normal loan offers once you get our acceptance for these loans. We will need you to ensure your sound financial health in recent times.

-

Text loans

This financing option defines small loans available for bad credit also. A simple text message from your mobile can fetch you these loans from our end. The borrowing process will take place in a paperless way.

You can be at any place while applying for these loans. In addition, the receipt of loans will occur in the most hassle-free manner. Again, through a message, you will learn about loan transfers to your bank account.

What to do to get bad credit loans on guaranteed approval?

Enhancing the approval odds is possible, provided you have taken a few precautions beforehand. Do not worry! We will try to find a few attributes in your financial behaviour. You may rest assured that these aspects can help to get guaranteed bad credit loans.

We know you must be dying to know about them. Here they are:

Payment handling of ongoing times: We expect you to pay off present bills promptly. It will show that you have money to disburse payments on time. You can afford money for loan repayments. Therefore, if your recent payment handlings are convincing, it enhances the suitability of your financial condition.

Sincere credit rectification approach: We accept your credit scores. However, we will not be able to accept that you are not trying to get good credit scores. You must put in the effort to upgrade your credit ranking. You must plan for timely payments of outstanding dues. You can also boost your credit scores.

Demand for a reasonable loan amount: We would like to see if you have asked for a suitable loan amount. Be smart to choose a reasonable amount to make the most out of opportunities like bad credit loans with no guarantor restrictions. Your preference for an affordable amount indicates that you know your limits. You do not want to consider an amount that will not be manageable.

As a responsible lender, we offer loans that are almost obtainable on guaranteed approval, even when your credit scores are not good. Besides, our services include options like very bad credit loans with no guarantor, which you can get from us with no broker in the UK. These are available under special circumstances and intend to help people facing CCJ and bankruptcy who need financial assistance.

Can poor credit loans be useful under any circumstances?

Financing from direct lenders for poor credit can be cooperative in several circumstances. Your credit scores will no more define how you should utilise loans. We provide you with full freedom to spend loans for whatever purposes like:

- Manage urgent repair costs:Your car might need on-the-spot repair because of a major issue. Instead of considering other lengthy financing options, you can apply for same-day loans for bad credit with no guarantor facility. These loans will reach you no sooner despite your credit flaws. You will not have to involve any guarantor for these loans.

-

Cover the unexpected bills: You have received a message about pending hospital bills. However, you do not have sufficient funds to clear it now. In this scenario, you can utilise these loans to cover the medical expenses. Settling immediate payment of bills becomes easy with the help of these loans.

-

Sponsor a holiday: If you plan to go on a vacation, but your pocket is empty, you can manage the holiday expenses with loans for poor credit. You can get these loans at budget-friendly rates. Get the liberty to draw out the money that you need. Remember, you will need to repay after coming from the holiday.

-

Festivity celebrations: If you have to stop the festive preparations temporarily due to money shortage, you can check out our Xmas loans for bad credit. It lets you gather the necessary cash to keep up with the festivity costs.

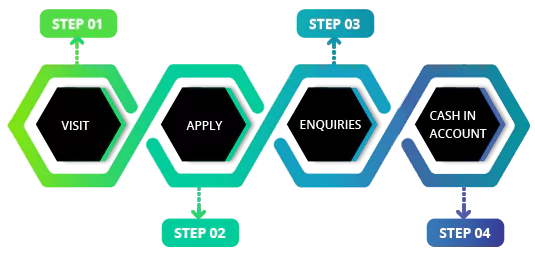

How does the process of getting loans with bad credit work?

You will not have to go through prolonged steps like collateral pledging etc. while applying for unsecured loans for bad credit. The loan application process will be seamless for you. It is not all stretched and includes necessary steps only like:

- Access to an online form for the application

- Inclusion of information in the form

- Re-assessing of details included

- Submission after final confirmation

- Minimal layover for our decision

- Transfer of money after instant approval of loans with bad credit and no guarantor

We make sure that the process remains swift and precise for you. At the same time, we will take care that the repayment procedure will be uncomplicated for you. It is possible because of our flexible repayment structure. It facilitates you to spread out the amount over months. Therefore, you can repay in small amounts without causing any disturbance in the monthly budget.

The same repayment formula would work with loans for bad credit with no guarantor, as these are available with no fees but on instant decision. You can give your consent to pay back loans weekly, fortnightly, or monthly. As you do not have to pay in full, you can continue with whatever repayment format.

Why CashFacts?

We have made available loans for bad credit online. It has already reduced the hard work you used to put in for a traditional loan. It does not matter if you have been declined for loans a few more times.

Our lending structure is compatible with any person who cannot make it to a loan application due to unfavourable credit history. After getting in touch with us, you can easily recognise our realistic approach to making things easy for our borrowers. We are aware of the competition in the lending market. However, our forte is always to serve you best by offering options like direct lender loans for bad credit.

We know our services have to match the changing requirements of the borrower. With time, we would like to upgrade our way of working and optimise our offerings for your best interest.

Following are some hidden features you will experience once you apply with us.

Amicable lending: We do not operate like mainstream lenders. We are friendlier to approach and discuss financial concerns.

Trusted support: We ask for the information we require from you. Therefore, safeguarding your privacy is our responsibility.

Any time assistance: Our website is accessible round the clock. In addition, we also remain active most of the time to help and guide our borrowers.

Flexible conditions: We are not a strict lender. Our conditions are practical and genuine.